Global liquidity is expanding. In the past three months, the global money supply has soared by $4.7 trillion.

Global liquidity is expanding. In the past three months, the global money supply has soared by $4.7 trillion.

This rapid increase started when the Federal Reserve panicked the first time and delayed the normalization of the balance sheet in June.

Since then, we have seen a chain of fresh stimulus policies implemented by developed economies, adding to the large fiscal packages already in place.

Multi-trillion-dollar investment packages like the EU Next Generation Fund now include massive deficit spending plans.

However, money velocity is not rising.

All these programs only lead to secular stagnation. Government projects and current expenditures are consuming money at an unprecedented rate.

Developed economies cannot live without new and larger spending plans. The result is more debt, weaker productivity growth, and declining real wages.

In a recent report, Bank of America showed that the rise of unproductive debt has created a significant problem for the United States economy.

For every dollar of new government debt, the gross domestic product impact has slumped to less than fifty cents. The United States is drowning in unproductive debt.

However, at least the United States has some productivity growth.

If we look at the euro area, the negative multiplier effect of new government debt is extremely evident.

Despite enormous stimulus plans and negative nominal rates, the euro area has been stagnating for years.

Many of you may believe that bad policies and careless government spending are to blame, but I think this is intentional.

It is a slow process of nationalizing the economy.

Read more... Most people consider Bangladesh a basket case country – all crowded overpopulated poverty constantly flooding etc. Yet I found it to be extraordinarily beautiful. The Shuvalong Falls here is just one example. It’s in the Chittagong Hills near the border with Burma. You’ll find Hindu shrines, massive mountain top Buddhist temples, small Moslem mosques, and a Christian church in almost every village

Most people consider Bangladesh a basket case country – all crowded overpopulated poverty constantly flooding etc. Yet I found it to be extraordinarily beautiful. The Shuvalong Falls here is just one example. It’s in the Chittagong Hills near the border with Burma. You’ll find Hindu shrines, massive mountain top Buddhist temples, small Moslem mosques, and a Christian church in almost every village

[In last Friday’s HFR, you learned that beloved TTPer Yasuhiko Kimura has Stage 3 Esophageal Cancer. Many of you have already been kind enough to donate to the

[In last Friday’s HFR, you learned that beloved TTPer Yasuhiko Kimura has Stage 3 Esophageal Cancer. Many of you have already been kind enough to donate to the

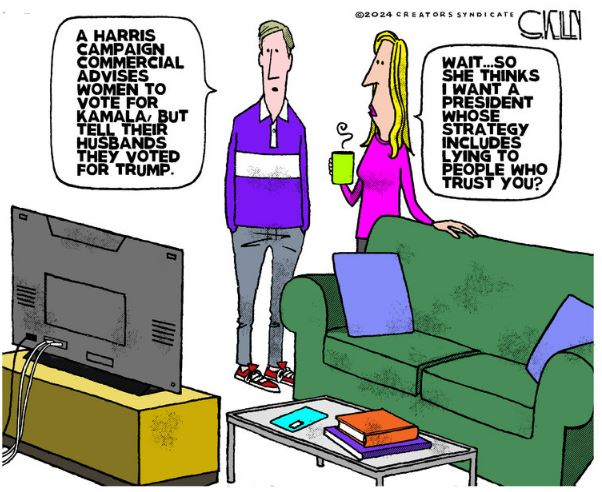

Harris and Walz have made a thing of “turning the page,” but the page that must be turned is the one they are on.

Harris and Walz have made a thing of “turning the page,” but the page that must be turned is the one they are on.

Global liquidity is expanding. In the past three months, the global money supply has soared by $4.7 trillion.

Global liquidity is expanding. In the past three months, the global money supply has soared by $4.7 trillion.

Hypersonic technology is critically important, so it’s time to check in to see where we now stand. According to news reports, nothing much has changed.

Hypersonic technology is critically important, so it’s time to check in to see where we now stand. According to news reports, nothing much has changed.