ITALY IS THE FIRST BREXIT DOMINO

Italy is preparing a €40bn rescue of its financial system as bank shares collapse on the Milan bourse and the powerful after-shocks of Brexit shake European markets.

An Italian government task force is watching events hour by hour, pledging all steps necessary to ensure the stability of the banks. “Italy will do everything necessary to reassure people,” said premier Matteo Renzi.

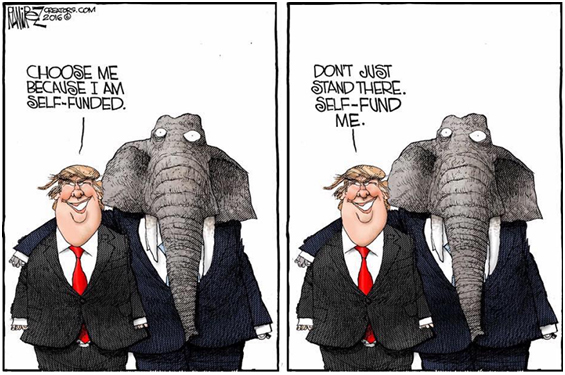

“This is the moment of truth we have all been waiting for a long time. We just didn’t know it would be Brexit that set the elephant loose,” said a top Italian banker.

The share price of banks crashed for a second trading day, with Intesa Sanpaolo off 12.5%, and falls of 12% for Banka MPS, 10.4% for Mediobana, and 8% for Unicredit. These lenders have lost a third of their value since Britain’s referendum five days ago.

“When Britain sneezes, Italy catches a cold. It is the weakest link in the European chain,” said Lorenzo Codogno, former director-general of the Italian treasury and now at LC Macro Advisors.