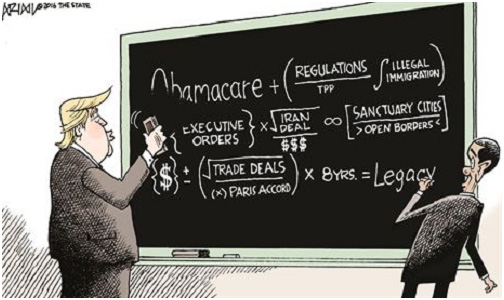

THE GLOBAL FINANCIAL EARTHQUAKE OF A TRUMP DOLLAR

The soaring US dollar is causing mounting strains for the global financial system and ultimately threatens to set off a f ull-blown banking crisis in emerging markets, the world’s top’s economic watchdog has warned.

ull-blown banking crisis in emerging markets, the world’s top’s economic watchdog has warned.

“We have all the symptoms of a dollar shortage,” said Hyun Song Shin, chief economist at the Bank for International Settlements (BIS).

The warning came as the closely-watched dollar index (DXY) appeared close to breaking through key resistance levels to a 14-year high, a move likely to trigger a stampede into the US currency as hedge funds and momentum traders join the chase.

The danger is that the powerful and immediate effects of financial tightening will “swamp” any trade benefits for the rest of the world from Donald Trump’s stimulus plans and a stronger dollar, even for countries that export heavily to the US. “It may not be very good news for anyone,” Mr. Shin told a specialist forum at the London School of Economics.

The BIS estimates that dollar debt outside US jurisdiction - and therefore lacking a direct lender of last resort - has risen five-fold to $10 trillion over the past 15 years. The great unknown is what will happen to China, where corporate debt has mushroomed to 145% of GDP.