THE END GAME FOR JAPAN?

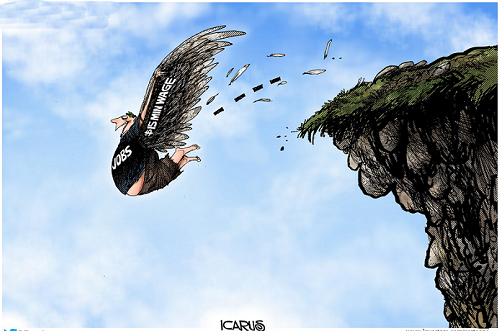

Lake Como, Italy. Japan is heading for a full-blown solvency crisis as the country runs out of local investors and may ultimately be forced to inflate away its debt in a desperate end-game, one of the world’s most influential economists has warned.

Olivier Blanchard, former chief economist at the International Monetary Fund, said zero interest rates have disguised the underlying danger posed by Japan’s public debt, likely to reach 250% of GDP this year and spiraling upwards on an unsustainable trajectory.

Speaking Monday (4/11) at the Ambrosetti Forum of world policy-makers on Lake Como, he said, “To our surprise, Japanese retirees have been willing to hold government debt at zero rates, but the marginal investor will soon not be a Japanese retiree.”

“If and when US hedge funds become the marginal Japanese debt, they are going to ask for a substantial spread,” he told me. Analysts say this would transform the country’s debt dynamics and kill the illusion of solvency, possibly in a sudden, non-linear fashion.

Prof. Blanchard did not elaborate on the implications of Japan’s woes for the global financial system, but they would surely be dramatic. Japan is still the world’s third largest economy by far. It is also the global laboratory for an ageing crisis that the rest of us will face to varying degrees.