THE COMING CHINESE DEVALUATION DISASTER

China's property market went mad after the authorities poured fuel on the flames. Beijing is now slamming on the brakes.

China's property market went mad after the authorities poured fuel on the flames. Beijing is now slamming on the brakes.

Capital outflows from China are accelerating. The hemorrhage has reached the fastest pace since the currency panic at the start of the year.

The latest cycle of credit-driven expansion has already peaked after 18 months. Beijing has had to slam on the brakes, scrambling to control property speculation that the Communist authorities themselves deliberately fomented.

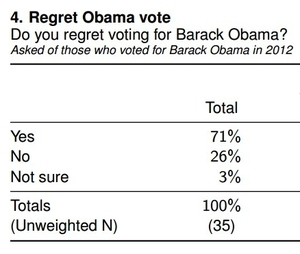

The central bank (PBOC) spent roughly $50bn defending the yuan last month, but this has not stopped the exchange rate sliding to 6.77 against the dollar - the weakest in six years.

"Our view is that the RMB (yuan) will depreciate 20% against the US dollar to 8.1 by the end of 2018 as deflation of the property bubble leads to more capital outflows," says Zhiwei Zhang from Deutsche Bank. "This is deflationary for global trade."

That is an understatement. A Chinese devaluation on this scale would be an earthquake for the world's economic and financial system, unleashing a tsunami of cheap manufacturing exports into Europe and the US. The world cannot absorb the consequences of so much excess.