WHY HIGH-TAX POLITICIANS ARE ALWAYS WRONG

If you were really hungry and given the choice of half of an eight-inch pizza or a third of a twelve-inch pizza, which would you choose?

If you were really hungry and given the choice of half of an eight-inch pizza or a third of a twelve-inch pizza, which would you choose?

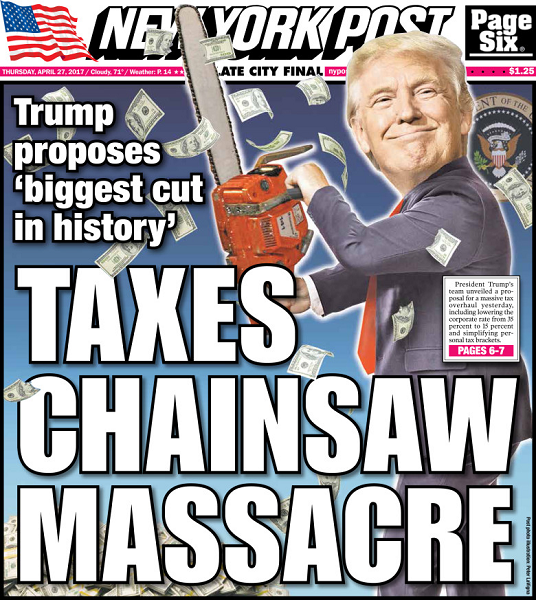

Already, the normal group of know-nothings among the political class and the press are proclaiming that President Trump’s proposed reduction in the corporate tax rate will only benefit the rich. The safe bet is all those folks are wrong, once again.

Those who view the world in static rather than dynamic terms, including some of the official revenue-estimating offices, claim that reducing the tax rate on a company that made a $100 million profit from the current 35 percent to the proposed 15 percent will cost the U.S. Treasury $20 million.

That statement is only true if the tax change was made retroactive for last year’s income. The wiser person understands that there are no constants, perhaps with the exception of the speed of light. When everything is a variable, including time, first-order observations are usually at least in part wrong.

This is why models that claim to statically forecast entire economic systems (which depend on accurately predicting human behavior) or climate systems over long periods of time are close to useless.